direct deposit owner's draw quickbooks

Costumer for a prior sale the transaction increases the cash account balance and increases the accounts receivable balance. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business.

Question Can I Pay A Draw Through Quickbooks Payroll Seniorcare2share

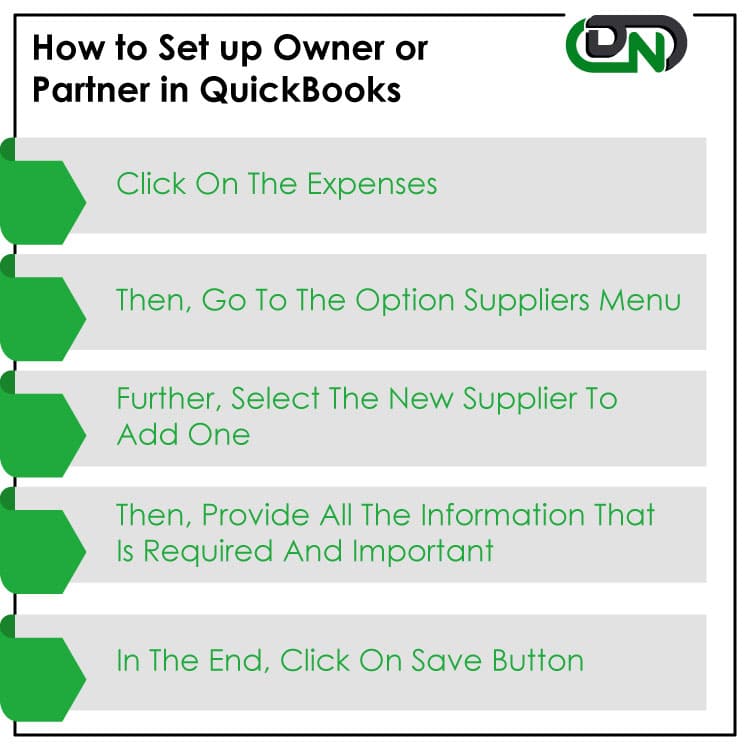

Withing QBO you will find the Workers tab where you can find company vendors that.

. Go to ACH Universal. This will net the expense to zero and your records will match the bank statement. QB made the two small deposits which weve verified too.

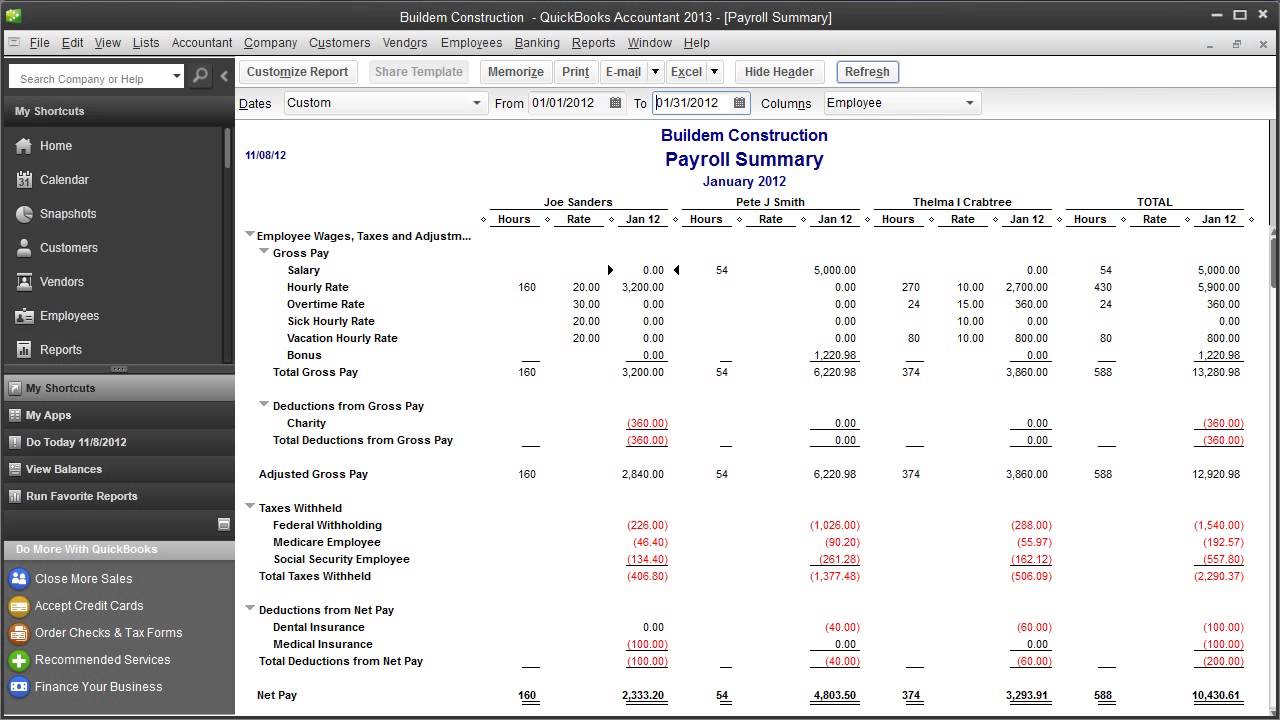

Only the direct deposit payroll transactions should appear in the window. Here you can choose the Chart of Accounts menu. Log in to the Employee menu and choose Payroll Taxes Payments and Liabilities.

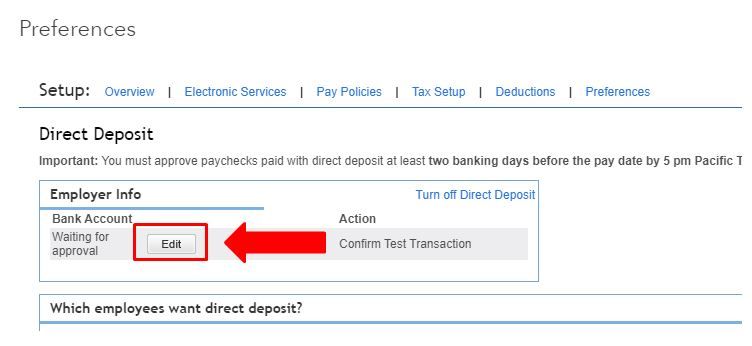

If you have been wondering about paying your 1099 Contractors with Direct Deposit now you can if you are a QBO Payroll or QBO Full-service Payroll user. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. The Intuit Quickbooks payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit.

Account 1 Account 1 type. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. In the Enhanced Payroll Manage Account section it shows the new bank.

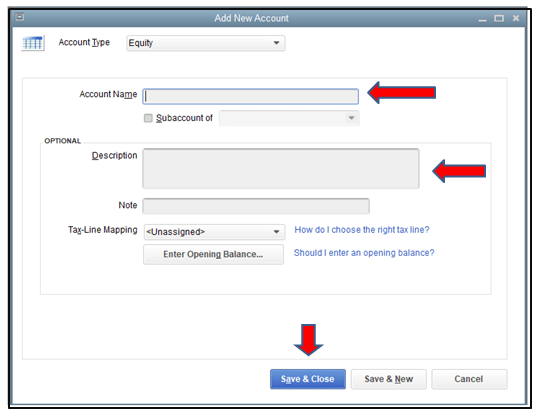

Start paying employees using Direct Deposit. Click Save Close. Choose the option Detail Type from the given drop-down menu to choose the Owners equity or Partners equity.

2 days agoHelping business owners for over 15 years. In the Verify Your Company Information zone. In this Agreement Service means whichever services you use.

Split direct deposit of payroll checks for employees between two bank accounts. The valuation principle of fair value accounting applied to investments classified as available-for-sale securities. Guarantee the Zip code has only 5 digits.

Enter the employees financial institution information and then click OK to save the information. Also you will need to Name and Authorize your employer to. You have an owner you want to pay in QuickBooks Desktop.

Or you can use the convenient Direct Deposit feature additional fees and setup required. A Community of users for Quickbooks Online Pro Premiere and Enterprise Solutions. See telpayca for more details.

Register For Direct Deposit Go to the Employees menu select My Payroll Services by then Activate Direct Deposit. QBO - Pay Contractors with Direct Deposit. Youll want to reverse the check.

You will find the Accounts Affected. This has always been ok up until now. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to.

Save up to ten years of COA history. Its important to note that draws arent taxed at the. Paycheck direct deposits andor payroll tax payments including related tax filings and preparation of W-2s.

You can then reissue the payroll check s. Click Equity Continue. Thats where the owners draw comes in.

Print Pay Cheques Once youve reviewed your pay cheques you can print them from your computer. Direct Deposit in the Employee Information section. Select the date range and click on the check once youve located it.

Create the paychecks in QuickBooks. Now choose the new button. QuickBooks Payroll calculates earnings payroll taxes and deductions.

Make prior-year adjustments easily with balances automatically updated that are affected by. This will bring up a calender format with all of the respective payments made to the given employee or client doesnt necessarily have to be an employee. We are in the process of switching banks and Ive made the adjustment in QB Desktop 2020.

You may apply for QuickBooks Direct Deposit service QuickBooks Assisted Payroll service or both services. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. You can either set up your direct deposit while setting up payroll or by going to EmployeePayroll InfoDirect Deposit.

Enter the account name Owners Draw is recommended and description. Accounting Create a customizable chart of accounts COA. When you attempt to make a direct deposit payment to an owner it specifically says something like in order to comply with the law direct deposit payments can only be made to independent contractors.

Details To create an owners draw account. From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment. When a company receives cash from a.

Click Adjustment Payroll Liabilities under Salary. To cancel a direct deposit go into the employees menu and select EditVoid Paycheck. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep.

New things are always rolling out for QuickBooks Online to make work easier. Complete and review the structure. To find the adjustment that affected your report click the Previous Adjustment button.

All Intuit QuickBooks Online Payroll plans include free direct deposit and you can pay your contractors in the application as well. Update any owner information if needed. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

Steps to Recording an Owner Contribution in Quickbooks. You will need to decide which Account or Accounts you wish your payment to be deposited to then report the information defining the target Account s. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner.

At the bottom left choose Account New. Most small business owners pay themselves through something called an owners draw. Do not send this form to Intuit.

To set up your company for direct deposit in QuickBooks verify your companys information including the legal name address EIN and industry. The IRS views owners of LLCs sole props and partnerships as self-employed and as a result they arent paid through regular wages. From the main menu select QuickBooks QuickBooks Integration.

Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts. Select the Account type option in a bid to select the Owners equity option. To write a check from an owners.

Do whatever it takes not to consolidate the growth. This document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. What this means is you would enter a deposit for the amount of the check using the same account s.

Quickbooks is confusing its users on this topic. Assign the date range and then select View Transactions. Confirm the totals and count and then Send to ACH Universal to create your ACH file.

How To Record Owner Investment In Quickbooks Set Up Equity Account

Owner S Draw Quickbooks Tutorial

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Tutorial Pay A Contractor With Direct Deposit Quickbooks Online Youtube

How Do I Pay Myself Owner Draw Using Direct Deposi

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

Question Can I Pay A Draw Through Quickbooks Payroll Seniorcare2share

Question Can I Pay A Draw Through Quickbooks Payroll Seniorcare2share

How To Record Owner Investment In Quickbooks Set Up Equity Account

Question Can I Pay A Draw Through Quickbooks Payroll Seniorcare2share

How To Run Payroll Set Up Direct Deposit In Quickbooks Online Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How Can I Pay Owner Distributions Electronically

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

Intuit Quickbooks Payroll Increase Direct Deposit Limits Youtube

How Can I Pay Owner Distributions Electronically

Solved I Am Trying To Change My Direct Deposit Account Te